Financing

BAC Medical Tourism has partnered with Prosper (the world's largest peer-to-peer lending service), eMedical Financing Solutions (a medical lending industry leader) and Medical Loan Finance Company (MedLoanFinance.com) to be able to offer financing to BACMT's patients for their medical / dental procedures and treatments. Being the largest lending services, these three companies are able to provide the lowest medical loan rates anywhere in the financing industry.

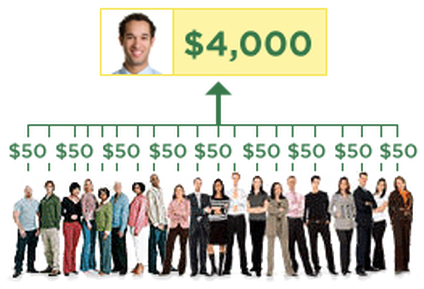

In peer-to-peer lending, borrowers post loan requests on the above companies' websites, via the advertisement links below, and these loans are invested in by many lenders. Thus, a person borrowing $10,000, may have dozens and dozens of lenders investing in the loan. These companies act as the platform, and collect and distribute all the money, through the loans on their sites.

Benefits of Loans for the Borrower:

How Long Does the Borrowing Process Take?

Here's How it Works:

In peer-to-peer lending, borrowers post loan requests on the above companies' websites, via the advertisement links below, and these loans are invested in by many lenders. Thus, a person borrowing $10,000, may have dozens and dozens of lenders investing in the loan. These companies act as the platform, and collect and distribute all the money, through the loans on their sites.

Benefits of Loans for the Borrower:

- Application is online and takes less than five minutes

- Fixed loan rates from 6.73% to 35.84% APR (lower than any other financing for medical loans)

- Loans are unsecured. No collateral required

- Fixed rate - Interest rate never changes for life of loan

- Multi-year terms

- Easy monthly payments

- Loan sizes from $2,000 to $35,000

- No prepayment penalties

- No upfront fees - Origination fees depend on credit rating of borrower and are taken from the loan proceeds

How Long Does the Borrowing Process Take?

- Five minutes to get pre-qualified online

- 15 minutes to draft the loan listing

- One day to two weeks for lenders to fully commit to the loan

- 24 hours after loan is fully committed and verification documents are received, the patient receives funds

- Some patients get their funds within three to four days of first application

- The average patient borrower has the funds deposited directly into their account within eight days of submitting their application

Here's How it Works:

- Borrowers choose a loan amount, purpose and post a loan listing.

- Investors review loan listings and invest in listings that meet their criteria.

- Once the process is complete, borrowers make fixed monthly payments and investors receive a portion of those payments directly to their account.

To find out today if you qualify for a medical or dental loan, please click the ads below:

Canadian Patients

For Canadian patients, financing is available through Medicard, 'Canada’s Patient Finance Company.'

For Canadian patients, financing is available through Medicard, 'Canada’s Patient Finance Company.'